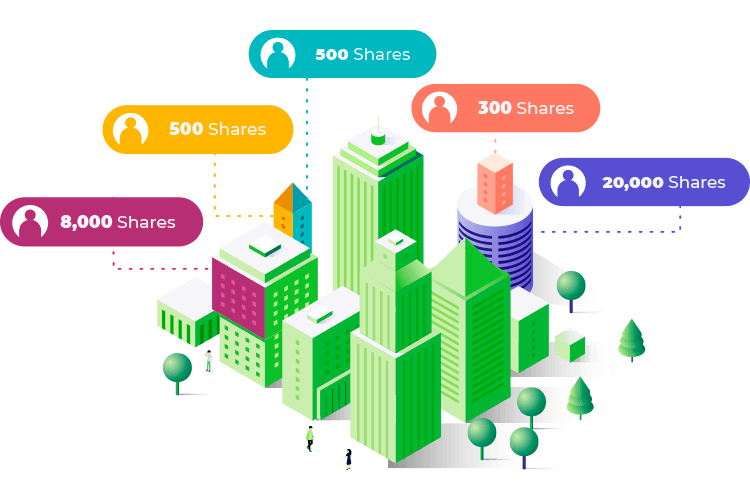

Looking to enable your asset for trading in a web3 environment?

DIBS’ TokenSuite platform makes it easy to issue, manage and allocate tokens. You’ll leverage blockchain for its decentralization, transparency and immutability and discover the benefits of automated Books and Records, KYC/AML whitelists, distribution of funds, and financial due diligence that’s integrated directly into the token. Tokenization creates a paperless way to manage investors compliantly.

Apply For TokenizationLearn More